2025 Ira Contribution Limits Spouse. $7,000 per individual in 2025. — a spousal ira is a type of retirement savings that allows a working spouse to contribute to an individual retirement account (ira) in the name of a nonworking spouse.

— you can contribute those amounts to both your and your spouse’s iras for up to a maximum of $16,000 if both of you are 50 or over. The most you may contribute to your roth and traditional iras for the 2025 tax year is:

2025 Ira Contribution Limits Spouse Andree Atalanta, — the roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older.

2025 Ira Contribution Limits Spouse Andree Atalanta, — 2025 ira contribution and deduction limits effect of modified agi on deductible contributions if you are covered by a retirement plan at work.

2025 Ira Contribution Limits Spouse Andree Atalanta, — the ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Spouse Roth Ira Contribution Limits 2025 Sella Felisha, In 2025, the contribution limit is $7,000 per year, up from.

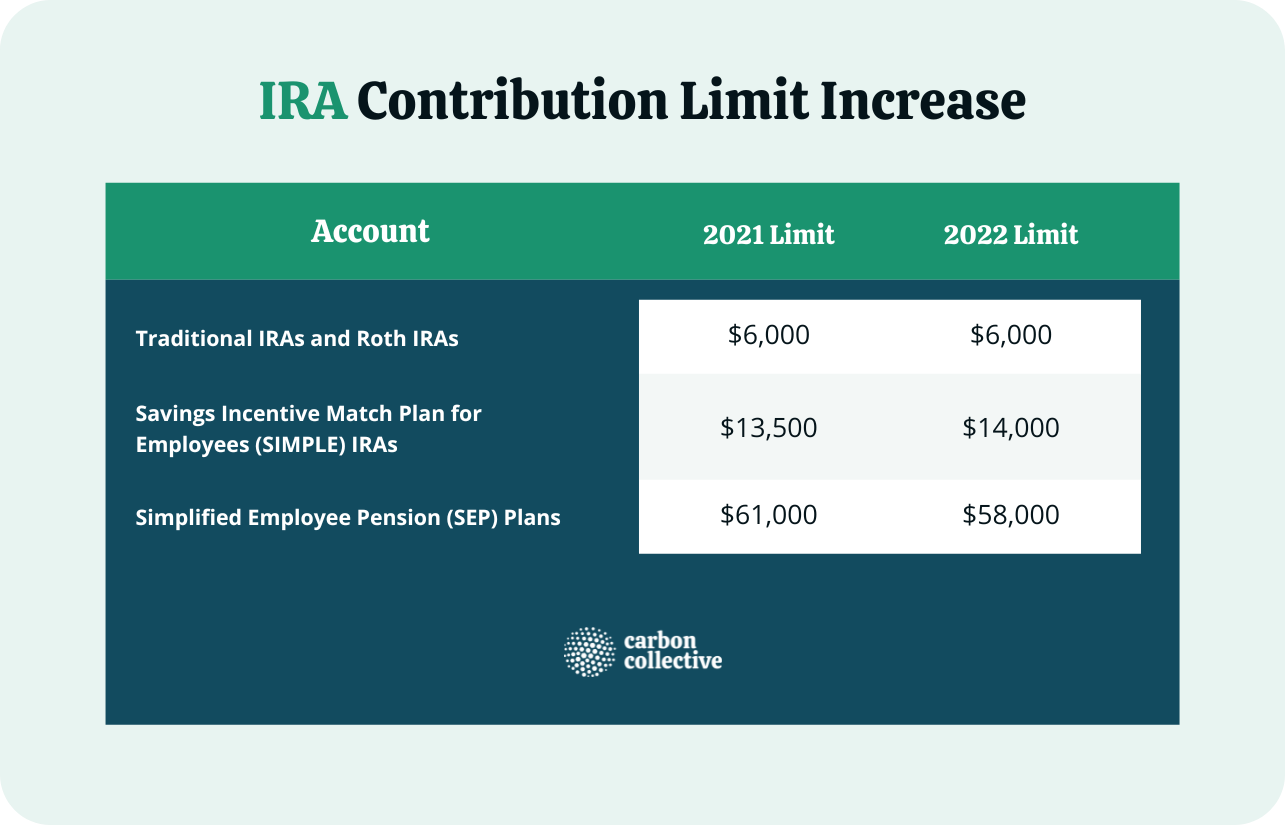

Maximum Simple Ira Contributions For 2025 Annis Brianne, Use our ira contribution limit charts below to see how.

2025 Ira Contribution Limits Spouse Andree Atalanta, — married, filing jointly, with spouse workplace plan:

401k Limits 2025 Married Filing Jointly Ally Hortense, — 2025 ira contribution and deduction limits effect of modified agi on deductible contributions if you are covered by a retirement plan at work.

Irs 401k Total Contribution Limits 2025 Lory Donnamarie, If you're covered by a retirement.

Max Roth Ira Contributions 2025 Married Amil Maddie, Those limits reflect an increase of $500.